Beyond the Sprint

Why it is important for an Agile software development team to understand that the work they produce is a corporate investment expected to yield value in the form of an internal process improvement or marketable commodity.

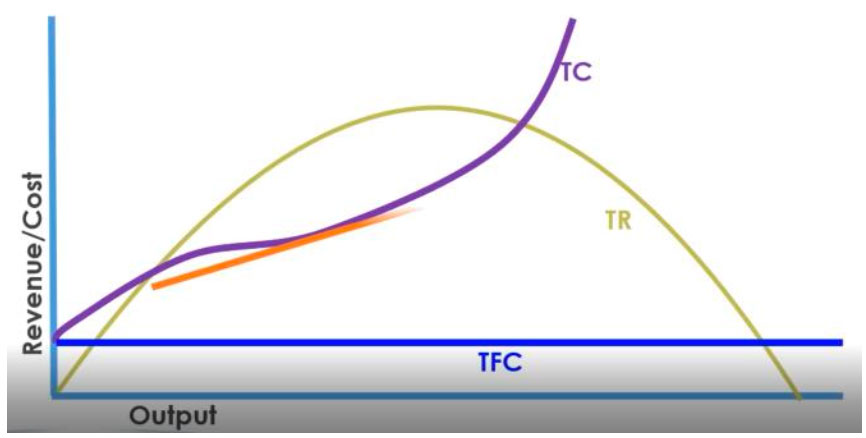

If an Agile software development team is treated merely as a “staff augmentation” line item, and not as a strategic partner in an investment project, there is a high risk that stakeholders will not achieve the results they originally intended – they will not achieve maximum process development / improvement levels, cost savings, or highest possible returns on investment that the business has intended. The teams in such a scenario risk falling into an “order-taking” mindset vs. a more proactive and innovative mindset. If this occurs, the project execution results risk being only marginally better than in a “Waterfall” approach…the return on investment will be low, because sprint over sprint, low-commitment “order-takers” will not succeed in delivering the highest quality of acceptable software…this phenomenon results in reduced value delivered over the duration of the project. In other words, in terms of cost analysis, the company will have just paid for less than they had planned for.

What do we actually mean when we try to differentiate between “staff augmentation” and “partnership”? In various Agile methodologies, we keep hearing about alignment with management, we keep hearing about the “common mission”. But in the Consulting world, Agile Coaches also see continual treatment of contractors as second-class citizens. There is a true story from one particular company where a cubicle was set aside as a “snack station”, but management had put up a printed sign saying “for full-time employees only” (i.e. not contractors). Yet, the majority of Agile Development teams in that department were comprised of contractors.

This may seem as a blatant and even extreme case of management overreaction to insulate the company against the delicate legal risks associated with laws governing “co-employment” in the United States, but there are many other more subtle examples of “segregation” that result in “walls” and “silos” being artificially constructed between people who should feel like “partners” in an important investment journey.

However, even when we are in a situation where an Agile team DOES consist of “full-time” employees, there are other dysfunctional conditions that can result in similar “walls”, “silos”, and ultimately the same “order-taking” mindset that results in process inefficiencies, lack of accurate adaptive planning, increased project costs, reduced return on investment, and poor project execution overall.

To solve this problem, there are two subtle “mindset adjustment” options of looking at the solution, but the desired result remains the same:

- Either management “joins” the Agile team and “follows” the path and solution by “providing intent” and trusting the experts to carve the path (just like David Marquet in “turn that ship around”)

- Management “invites” the Agile team to participate in the process that carves and defines the investment stragegy.

Both angles result in the same favorable situation:

- Teams are engaged in the process

- Teams understand their purpose

- Teams feel like they are “partners” in the process, and not “order-takers”

- Teams understand their value

- Teams can help with cost vs. value decisions in order to help the firm maximize ROI

- The company

The point here is simple. A company decides to embark on an investment in human capital to form an Agile team. Yes, that human capital can consist of contractors or full-time employees. However, in order to maximize value out of this investment and reduce overall costs, the company must treat these teams as partners in the investment plan.

Responses