Introducing “Value-Side” Thinking & Decision Making

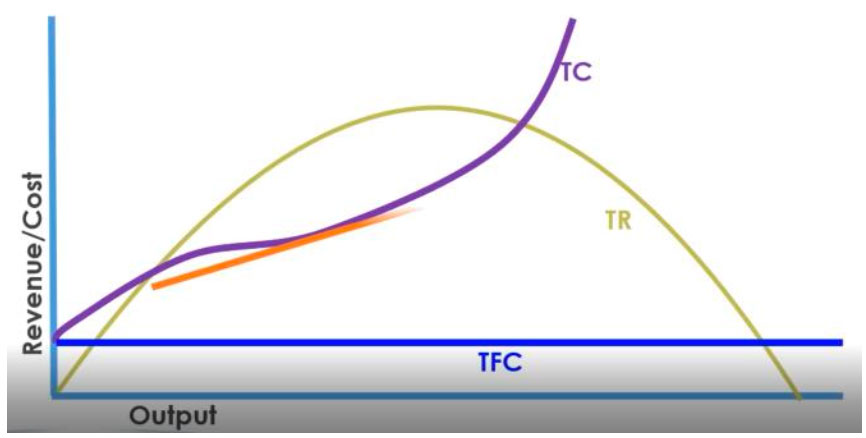

Problem Statement: It is common for corporations to focus on “cost-cutting” measures. While it is an extremely important economic principle to maximize profits by lowering costs, ignoring the impacts of business investment decisions on value creation can be detrimental to the quest for maximum profits. In this light, making cost-based or “cost-side” decisions without adding “value-side” thinking and decision making is not advisable.

Analysis: From a consumer perspective, it is easy to visualize the relationship between cost & value. The economic principles of elastic and inelastic demand have been studied and well documented for many decades. The internet is full of articles on what happens to SUV sales as gasoline prices rise or fall. The consumer is influenced by the “long term cost to operate” as an offset to the “value obtained”, and as a result, the price of gas dictates the boundary of “value- side” decision making in the SUV market.

At a more analytical level, the value consideration for any consumer investment decision can fall under one or more of these categories:

- Tangible Return on Investment

- Cost Avoidance

- Compliance or reduced risk exposure

- Other Intangible ROI – e.g. self-image, entertainment, etc

In a corporate setting, these categories do not change very much either. Frequently we

encounter the need to submit business cases for approval in order to justify investment in a

given project. The justification behind these business cases usually include Tangible and / or

intangible benefits that are prioritized against other such business cases.

However, it is also true that despite diligent corporate efforts to limit investments to the most valuable proposals each year, we encounter many case studies where incorrect assumptions about cost and value returned end up being exposed long after the investment has already been made. In a large subset of these case studies, the decision to proceed with the investment could have been prevented if a proper “Value-side” thinking and decision making mindset had been in place.

Example Case Study: Outsourcing to Reduce Costs

This is an all-too familiar scenario. A company based in the east coast of the United States decides to reduce operating costs by outsourcing a large portion of its IT development organization to a team of lower-cost resources 10 time zones away. On the books, the contract stipulates that there are only 2 hours of overlap during the day where on-shore and “off-

shore” employees and contractors can collaborate. The contract also secures labor at 50% of

the current rates paid by the company for on-shore resources.

On the surface, this looks like a great deal in the quest of increasing shareholder value. The

company will transition a certain amount of labor from one location to another, “saving” 50% of

the annual recurring labor costs along the way.

In actuality, these impacts were introduced as a direct result of this “cost-side” investment decision:

- Constraint of 2 hours per day of collaboration time. If the on-shore team had questions for the off-shore team outside of these 2 hours, responses would be delayed until the next day. From a working hours perspective, this is a delay of up to 6 hours (3 to 4 on average). In many cases, this would introduce a “block” or delay in progress. 2 to 3 of these instances per 2 week sprint were frequent. It is estimated that this situation of “waiting” for responses prevented up to 20% of additional work from being completed every sprint.

- In other cases, assumptions that may or may not have been correct would be made by the “on-shore” or “off-shore” team members in order to seemingly make forward progress. When the assumptions were incorrect, this would result in “re-work”. This “re- work” and miscommunication cycle resulted in an additional estimated 20% of inefficiency (lost output) during the course of each sprint.

Without going into other categories, it is clear that in this case, the 50% cost reduction gain has

come with a loss of team output of up to 40%. On the surface, someone might be quick to

argue this is still an aggregate gain…Yet, here is where things get tricky…given that we seek

maximum ROI from every investment, it is clear that we should expect more value from the work

that the team is delivering than it cost to produce this work…otherwise, why would we do it?

Why not “buy” vs. “build” instead? There is always an underlying expectation that positive ROI

must be true in this case study. If we were to keep things simple, and expect a 2x ROI, then we

have the following:

Cost avoidance by outsourcing – 50% (of the original investment)

Lost output by outsourcing – 2 x 40% = 80% (of the new investment)

Given that 100% of the “new” investment is actually 50% of the “original” investment, it becomes

clear that this company’s decision to outsource has not really been a good financial investment

in this case. Yet, who was considering the “Value-Side” thinking & decision-making parameters

when those decisions were being made?